There are a number of state-specific solar incentives for solar owners to take advantage of, such as tax credits and rebates. One of the most advantageous solar incentives you may be eligible for is solar renewable energy credits (SRECs).

When a solar company is informing you of SREC selling options, they may mention pre-selling your SRECs or offer fixed, guaranteed pricing for your certificates. There are certain advantages to proceeding with these options, but it’s important to understand the pros and cons of each before opting into any SREC agreement.

What are SRECs?

SRECs are a performance-based-incentive (PBI) which allow you to generate certificates based on the production of your solar panel system. Typically, you’ll generate one SREC for every 1,000 kilowatt hours (kWh) of electricity production. SREC incentives are only available in states that have set a renewable portfolio standard (RPS) to mandate that utilities must produce a certain percentage of their electricity from renewable energy sources. To meet these requirements, utilities purchase SRECs from home and business owners generating solar.

The amount of money you’ll receive from selling SRECs depends on not only the production of your system but the state you’re in and the specifics of the state SREC market. Different states will have different RPS requirements, durations for their SREC program, and more. For example, an SREC in DC can sell for more than $300, while an SREC in Maryland might sell for around $5. Massachusett’s SREC program lasts for 10 years, while Illinois’ program lasts for 15 years.

Selling SRECs is a bit like playing the stock market – the value of these certificates will fluctuate depending on supply and demand in the market at the time. Regardless of your SREC market, it’s typical to sell your SRECs to utilities via a broker or aggregator. These third-party companies will handle the transactions with the utilities and send you the money once the SREC is sold. With many brokers, you can have as little or as much control over the sale of your SRECs as you’d like. Some people choose to wait until SRECs reach a minimum value before allowing the broker to sell them, while others opt to sell their SRECs as soon as they’re able so they can receive the benefit sooner.

SREC brokers, solar installation companies, or solar financing companies will often have options to pre-sell the rights to your SRECs for a lump sum or offer a fixed pricing agreement where they will pay you an agreed upon price for each SREC, regardless of what they sell for. When you enter into a fixed pricing agreement, the contracts typically last anywhere from three to 15 years.

Benefits of pre-selling/fixed pricing SRECs

There are a number of benefits to pre-selling or entering into a fixed pricing contract for your SRECs versus selling them on the spot market.

Budgeting

One benefit of pre-selling your SRECs or opting into fixed pricing for them is that you’ll know exactly how much you’ll be earning ahead of time. Because of this guarantee, you’ll be able to better manage this additional income and possibly budget it towards other financial needs.

Paying down solar loans

Another benefit of these SREC selling options is that you can use the guaranteed income to pay down any sort of solar loan you used to cover the upfront cost of the system. This is particularly true when it comes to pre-selling the rights to your SRECs, where aggregators may give you a substantial lump sum that you can use to pay down your balance immediately. Many solar financiers will offer an option where you can enter a fixed pricing agreement with them, and automatically use that benefit to pay off monthly loan payments as they occur.

Peace of mind

Lastly, one of the most valuable benefits to pre-selling SRECs or selling your SRECs for a fixed price is peace of mind. With these options, you don’t have to worry about what’s occurring in the market, or whether there’s an oversupply that may result in a price drop. You’ll have protection against fluctuating prices that people selling SRECs on the spot market will be susceptible to.

With the added peace of mind often comes lower financial returns, which leads to the biggest disadvantage of pre-selling SRECs or opting into a fixed pricing contract.

Disadvantages of pre-selling/fixed pricing SRECs

While there are a number of advantages to pre-selling opting into a fixed-price contract for your SRECs, there are also some downsides. The biggest disadvantage to pre-sell/fixed price agreements is that there’s a good chance you’ll earn a lower overall reward for the sale of your SRECs than you would if you were selling them on the spot market.

When financiers, SREC brokers, or solar installers offer you a certain price for your SRECs, it’s typically because they believe they’ll make a profit. The companies usually have analysts that forecast what the SREC markets will look like down the line, and offer a price that may still be worthwhile for you, but will also result in returns on their end.

Which option is best for you?

The good news is that regardless of how you sell your SRECs, these certificates will help increase your overall solar electricity savings. Any SREC value, small or large, is better than none at all. But, as you’re considering how you want to sell your SRECs on the market, a lot of it can depend on personal preference and what your risk tolerance is.

To return to the investment market analogy, stocks are typically known as having a higher risk but higher payoffs, while bonds are less volatile but often come with a lower reward. Your SREC selling options are similar. If you’re going to sell your SRECs on the market, it’s more comparable to investing in stocks, while pre-selling your SRECs or entering a fixed price arrangement would be a bit comparable to investing in bonds.

When you’re evaluating which option to proceed with, it’s going to be a tradeoff between how much of a risk you’re willing to take on versus how much you’re looking to earn in SREC benefit. Before deciding, it’s always a good idea to look at historical and current pricing for your given SREC market. One of the more popular aggregators, SRECTrade, is a good resource for this information. SolSystems, another popular broker, also offers information on most-recent SREC sales.

Shop for solar on EnergySage

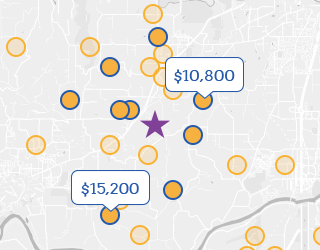

By joining the EnergySage Marketplace, you can compare multiple solar quotes from pre-screened, local installers. If you’re located in an active SREC market such as Massachusetts, New Jersey, DC, Pennsylvania, Maryland, or Illinois, your estimated SREC benefit will be automatically calculated based on standardized values and production estimates included in your quote. If you’re interested in pre-selling or a fixed-pricing option for your SRECs, simply note it in your account so that installers can follow up with additional information from brokers, financiers, and more offering these solutions.