One of the most important choices to make as you’re going solar is which installation company to work with. Online reviews, industry certifications, years in business, and equipment manufacturer endorsements are just a few ways to gauge the reputation and experience of one company over another. If you’re planning on financing a system with a solar loan, it’s a good idea to keep an eye out for any partnerships with loan financiers, as they can be another indicator of a company’s credibility.

What is the relationship between solar lenders and installers?

There are many ways to finance a solar panel system; select credit unions, municipalities, and utilities offer energy efficiency or home improvement loan options. Additionally, many homeowners finance solar investments through a home equity loan, or home equity line of credit (HELOC). However, if these aren’t an option for you, or simply an avenue you don’t wish to pursue, there are many lenders that specialize in solar lending, offering unsecured, zero-down loan options for homeowners who want to invest in solar with no upfront cost.

Unlike obtaining a loan through your local credit union or taking out a home equity loan, lenders offering these options don’t often work directly with property owners; instead, they partner with select solar contractors that propose their solar loan offerings as part of a turnkey solar solution.

Importantly, these solar lending companies don’t partner with just any solar installation company: lenders such as Sungage Financial, Dividend, and Mosaic–and others!–require installers to apply to join their network and only accept installer partners that they have confidence in.

Benefits of working with financier-approved installers

There are a number of benefits to working with installers that partner with solar lenders; for one, working with an installer that has a direct relationship with a financier means that you have at least one loan option easily accessible. Because the installer is partnered with the financing company, they can assist in the application process. These installers also tend to be knowledgeable about the details of the specific lender and their products, including a deep understanding of the various loan offerings, as a result of having worked with the financing partner for prior installations. However, not all solar installers not partner with financiers, meaning their solar customers need to obtain a solar loan on their own.

Additionally, lenders with installer networks typically require prospective partners to go through a thorough vetting process to ensure that they are properly licensed and qualified. Because these lenders have ongoing relationships with their solar customers, they want to be sure they’re only associating their brand and offerings with installation companies whose work and service they trust.

Lastly, several lenders require that their installer partners continue to meet certain customer satisfaction scores in order to maintain their partnership status. Because of the ongoing relationships with their borrowers, solar lenders often gather information about their customers’ overall experience with the solar process, both prior to and post-installation, and adjust their installer partnerships accordingly.

What financiers look for in installer partners

Since solar lenders don’t partner with every installer, what factors do they take into account when choosing their partners? Here are a few primary characteristics they look for:

Markets served

Many solar financiers only offer their loan products in specific markets, rather than nationwide. If you’re working with an installer that isn’t a partner of a specific financier, it’s possible that financier simply hasn’t expanded into your state yet.

Industry licensing, insurance, and certifications

Licensing and insurance requirements to install solar vary from state to state; however, regardless of a state’s requirements, lenders typically check applicable licenses and insurance (i.e. worker’s compensation policies, general liability) prior to partnering with a solar installation company.

Equipment options

Solar lenders work closely with more than just installer partners; many financing companies have their own “approved vendor” lists that detail which types of solar equipment can be purchased via their loan products. These approved vendors typically include both module and inverter manufacturers. Any installer partnering with a financier needs to install reputable equipment from their approved vendor list.

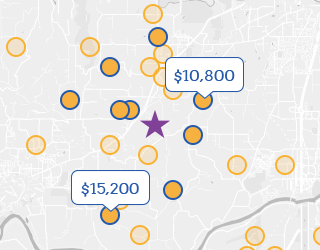

Find qualified solar installers on EnergySage

When it comes to installing a solar panel system, there are so many options available. Comparing multiple options helps ensure you are making the best decisions for solar equipment, installer, and finance option. Sign up on the EnergySage Marketplace to receive up to seven custom solar quotes from local solar companies. These quotes display information about the proposed loan, including interest rate, term, and lender. If you prefer one type of solar loan or a particular lender, simply note it in your account so installers can quote accordingly.