One question we field a lot at EnergySage is whether it’s the right time to install solar panels. For anyone asking that question in 2020, the answer is often as soon as possible: given the looming step down and expiration of the federal investment tax credit (ITC), solar shoppers who wait until 2021 or later to move forward will be missing out on major tax savings – but just how much?

In this article, we’ll give an overview of the federal tax credit, the timeline for the step down, and provide some tips for those looking to take advantage of the 26 percent federal ITC before the end of the year.

Please note: EnergySage has written on the topic of the ITC in good faith, with the aim of guiding you to make a well-informed decision about going solar. However, the US tax code is complicated, and what we have written should not take the place of advice from a qualified tax professional. Consult your tax advisor before deciding what is best for you.

What is the federal ITC?

The federal investment tax credit, also referred to as the solar tax credit, allows you to deduct 26 percent of the cost of your solar energy system from your federal taxes. Because this incentive is a tax credit rather than a deduction, you need to have sufficient tax liability in order to take advantage of the incentive. However, if you can’t use your entire solar tax credit in the first year, you can roll remaining credits over into future years.

The ITC is only available to those who purchase their solar panel system: property owners who sign a solar lease or power purchase agreement (PPA) are not eligible for the credit, as the owner of the system claims it for themselves.

You can read more about how to claim the ITC in our step-by-step guide.

Federal ITC step down timeline

The ITC was originally scheduled to expire in 2016. However, in late 2015, Congress passed a spending bill that included an extension of the credit. The bill stipulates that a solar tax credit will be available to homeowners until 2021, with an important distinction: the full 30 percent credit value only lasts until 2019. In January 2020, the tax credit value dropped 26 percent, and it declines even more to 22 percent in 2021. And at the start of 2022, the residential solar tax credit expires.

- 2019: the tax credit is 30 percent of the cost of the solar energy system.

- 2020: the tax credit is 26 percent of the cost of the system

- 2021: the tax credit is 22 percent of the cost of the system

- 2022: homeowners can no longer claim the solar tax credit

As far as commercial installations go, the commercial solar tax credit is the same as the residential tax credit up until the end of 2021. However, while the tax credit expires for homeowners on January 1, 2022, the commercial solar tax credit reduces and remains fixed at 10 percent onwards.

ITC savings: 2020 vs. 2021

While a 4 percent stepdown may not seem like much, it can equate to thousands of dollars in savings when you’re buying a solar panel system.

Below are examples of saving differences from 2020 to 2021. For these estimates, we used average cost data from quotes in the EnergySage Marketplace to calculate an estimated cost for 6 kilowatt (kW) and 10 kW systems in various states. Values have been rounded to the nearest dollar.

ITC savings 2020-2021: 6 kW

| State | Average cost of solar ($/W) | Gross cost for a 6 kW system ($) | 2020 tax credit value ($) | 2021 tax credit value ($) | Difference ($) |

|---|---|---|---|---|---|

| California | $2.94 | $17,640 | $4,586 | $3,881 | $706 |

| Florida | $2.69 | $16,140 | $4,196 | $3,551 | $646 |

| Illinois | $3.08 | $18,480 | $4,805 | $4,066 | $739 |

| Massachusetts | $3.10 | $18,600 | $4,836 | $4,092 | $744 |

| Texas | $2.81 | $16,860 | $4,384 | $3,709 | $674 |

| Utah | $2.89 | $17,340 | $4,508 | $3,815 | $694 |

ITC savings 2020-2021: 10 kW

| State | Average cost of solar ($/W) | Gross cost for a 10 kW system ($) | 2020 tax credit value ($) | 2021 tax credit value ($) | Difference ($) |

|---|---|---|---|---|---|

| California | $2.94 | $29,400 | $7,644 | $6,468 | $1,176 |

| Florida | $2.69 | $26,900 | $6,994 | $5,918 | $1,076 |

| Illinois | $3.08 | $30,800 | $8,008 | $6,776 | $1,232 |

| Massachusetts | $3.10 | $31,000 | $8,060 | $6,820 | $1,240 |

| Texas | $2.81 | $28,100 | $7,306 | $6,182 | $1,124 |

| Utah | $2.89 | $28,900 | $7,514 | $6,358 | $1,156 |

For some, the difference between claiming the ITC in 2020 and 2021 may be less than $1,000. But, the larger your system is, and the higher the cost of solar is in your area, the more you stand to lose from each ITC decline

How to ensure you’re eligible for the 26 percent tax credit

Time is of the essence when it comes to claiming the 26 percent federal ITC; here are some guidelines to follow in order to make sure you maximize your ITC benefit:

1. Start shopping for solar as soon as possible

Installing solar is a big decision, and one you shouldn’t feel rushed on. The sooner you start shopping, the more time you’ll have to evaluate your equipment, financing, and installation company options.

2. Before signing a contract, ask about timelines

Not every company will be able to install on the same timeline; their calendars vary depending on how many projects are already scheduled, as well as how many installation crews each company has. Before signing a contract, ask each company how soon they’ll be able to install your solar panel system.

3. Get your solar panel system installed before the end of the year

In 2018, the IRS released “commence construction” guidance which states that commercial entities investing in solar are eligible to claim the 26 percent ITC so long as construction on the project starts before January 1, 2021. However, this guidance doesn’t apply to directly-owned residential solar panel systems.

If you want to claim the 26 percent ITC for your own residential solar panel system, it’s important to make sure the system is “placed in service” before the end of 2020. As the Solar Energy Industries Association (SEIA) states:

If a homeowner buys the solar energy system outright (either paying cash or financing with a loan), they cannot use any commence construction safe harbor provisions…. It is not enough to have signed a contract, or to have made a down payment or even to have begun construction. There is no bright-line test from the IRS on what constitutes “placed in service,” but the IRS has equated this with completed installation in a Private Letter Ruling.

It’s always best to consult with your tax advisor or accountant on your unique situation. However, if you’re looking to play it as safe as possible, having an operational system by the end of 2020 helps ensure you’re eligible for the 26 percent tax credit.

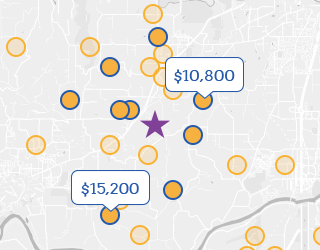

Compare your solar options on EnergySage

If you want to lock in the 26 percent tax credit, now’s the time to get started on your solar project. When you register on the EnergySage Solar Marketplace, you can receive up to seven quotes from pre-screened installers. All quotes on the Marketplace include solar incentives you’re eligible for, including the federal ITC. If you’d prefer to start with ballpark cost and savings estimates, try our Solar Calculator.