The best states to go solar aren’t always the sunniest; those who benefit the most from installing a solar PV system for their home spend a lot in electricity and live in a state with good solar incentives.

Illinois may not have the year-round sunshine of the Southwest, but it does have a great solar market because of the available financial incentives. In addition to the 26 percent federal solar tax credit for solar system owners, Illinois residents can receive additional financial benefits through the state’s solar renewable energy certificate (SREC) market.

Key points about IL’s solar incentive program

- Illinois’ SREC incentives are managed under the Adjustable Block Program

- Incentive values vary based on estimated solar production, the size of your solar installation, your utility company, and more.

- See how much you can save with this solar incentive on the EnergySage Marketplace

Solar incentives in Illinois

Illinois has a renewable portfolio standard (RPS) that commits the state to produce 25 percent of its electricity from renewable energy by 2025. Of that 25 percent, 1.5 percent must come from solar. Solar panel system owners can sell the SRECs that their panels produce alongside their electricity in order to help the state meet the solar requirement. This is why the renewable energy that Illinoisans produce has a monetary value in addition to offering savings on electricity bills.

In the past, the Illinois Power Authority (IPA) bought SRECs in “procurement rounds.” Solar system owners would typically sell their SRECs through an aggregator who acts as a broker between property owners and the state. These brokers will pay property owners for their SRECs on a quarterly basis over the course of five years, and sell the SRECs to the IPA during the specified procurement rounds. With the new SREC program, it’s a bit different – the current SREC program lasts for a longer duration, and the price you receive for each SREC is fixed and dependent on your utility company, system size, and how soon you go solar.

FEJA and the Adjustable Block (AB) Program

In 2017, the Illinois government created new legislation that altered the existing REC program structure in the state. The Future Energy Jobs Act (FEJA) took effect on June 1, 2017. This legislation is designed to stimulate job creation in clean energy, assist in the state in meeting its ambitious RPS goal by 2025, and promote energy efficiency.

FEJA includes a proposed new incentive structure known as the Adjustable Block (AB) Program, also known as the Illinois Shines program. Rather than the old five-year SREC program in Illinois, this new incentive structure lasts for 15 years worth of solar production. The SRECs are sold at a fixed price which is determined by contracts, rather than the variable market prices of the old SREC program.

The AB Program uses a “block” structure to determine the value of an SREC. The state set a specific amount of installed solar (in megawatts) and an associated SREC price for each block. Once that amount is reached in a set block, the incentive will transition to a new block with a lower price. The result is that, as more people install solar, there are fewer funds available for the incentive. The block you’re eligible for depends on a multitude of factors:

- Capacity: As blocks fill up, the price for one SREC will decline.

- Type of project: Community solar is eligible, but for different values than systems located on your property

- Size of your solar installation: Incentive values are categorized based on the alternating current (AC) rating size of your system, which is the size of the inverter (systems under 10 kW, 10-25 kW, 25-100 kW, and so on).

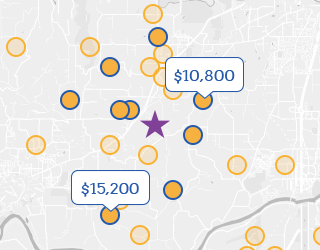

- Utility company: You’ll be placed into a specific block depending on your electricity distributor and your load zone.

Below is an image of the blocks and pricing information from the Illinois Power Authority. You can see the current block status here.

Here’s an example to help you interpret the proposed pricing. Let’s assume you own a solar panel system that will generate an estimated 10 SRECs each year, and you are a customer of Ameren. Under the Adjustable Block Program, if you go solar while there’s still capacity in block 1, your 10 SRECs a year would sell for $85.10 each. You’ll earn roughly $12,765 in SREC sales. If you install solar after block 1 fills up, you’ll be enrolled in block 2. Each of your 10 SRECs would sell for about $81.70, or $12,255 (a decline of $510).

Importantly, the pricing of your SRECs is fixed, and when you receive the incentive depends on the size of your solar panel system: if you’re installing a system with an inverter size of less than 10 kW, you receive your SREC incentive as an upfront lump-sum payment. However, if your system is larger than that, you receive the payments over the course of five years.

This incentive structure is very similar to the Megawatt Block rebate available in New York State, as well as the SMART incentive in Massachusetts.

How to earn SRECs in Illinois

The first step towards earning SRECs is to shop for a solar panel system. Once you move forward with a solar company, they’ll work with you and the state to ensure that your system is eligible for SRECs once it’s operational.

With these incentives in the works, it’s a great time to start evaluating your solar options. Register on EnergySage today to get quotes from local, reputable Illinois installers. The quotes would include current incentives available in your area. Alternatively, if you want to start out your process with an estimate of costs and savings associated with solar, try out our Solar Calculator.