Solar energy renewable certificates (SRECs) are some of the most attractive solar incentives available in the United States. Many states with renewable portfolio standards (RPS) have special “solar carve-outs” that require a certain amount of energy production to come from solar. These states use SRECs as a way to promote solar installations and compensate system owners for the energy their panels generate.

There are active SREC markets in just a few states across the country. Delaware, Illinois, Maryland, Massachusetts, New Jersey, Ohio, Pennsylvania, and Washington D.C. all currently have SREC programs, though the incentive can vary from market to market in terms of both duration and financial benefit. For example, homeowners in New Jersey benefit from 15 years of the incentive, while the Massachusetts SREC program lasts for five years.

In most cases, if you’re a homeowner in a state with an SREC markets, you’ll want to work with a third-party SREC aggregator, or broker, to sell the certificates to utilities on your behalf. There are a variety of options for SREC brokers, but one of the more popular options homeowners work with is SRECTrade.

How SRECTrade works

SRECTrade, based in San Francisco, California, is known as one of the largest SREC brokers in the industry. SRECTrade will handle the transaction of your SRECs while also providing online software and tools to track the performance of your SRECs. In addition to working with property owners to sell SRECs on their behalf, SRECTrade also works with utility companies, lease and PPA providers, and solar installation companies that maintain ownership of the systems they install.

Signing up on SRECTrade is pretty straightforward. The process can be done online after your solar panels are installed and connected to the grid. Often, your installer will assist with the process. SRECTrade handles any necessary regulatory measures necessary, and when the setup is complete, your system will start generating SRECs. Once the SRECs are sold in the market, SRECTrade will pay you.

Throughout the duration of your SREC program, your SRECTrade account will display the amount of SRECs sold thus far, a transaction history with the amount they sold for, and the date of sale.

Your options with SRECTrade

SRECTrade provides the option to have as much, or as little, control over your SRECs as you’d like. In an SRECTrade account, you can set up the minimum pricing you want to sell your SRECs for, and create the functionality to sell them as soon as the market hits that price. You can also choose to sell them as soon as they’re minted, regardless of the price. Alternatively, you can decide to give SRECTrade full rights to the sale of your SRECs and let them decide based on their expertise when to sell them.

SRECTrade also has some more unique options that are available to consumers depending on their preferences; depending on your market, SRECTrade may offer fixed pricing options for 1-5 years where they’ll pay you at a guaranteed amount, no matter what the SREC sells for in the market on their end. They also offer the option to sell the rights to your SRECs upfront, receive money for them in a lump sum.

Not only do SRECTrade or other aggregators offer this option, but some larger installation companies , as well as solar loan financiers,may also offer to buy the rights to your SRECs upfront or for a fixed amount. This can be a good option to consider if you’re looking to see savings more immediately and decrease your initial cost for owning a system, or if you would feel more reassured by the fixed pricing and not susceptible to the unpredictability of your SREC market. That being said, homeowners who sell SRECs over the duration of their respective SREC programs tend to earn more money over the years. While there’s more risk associated with the process because pricing of SRECs is dependent on supply and demand, there is also a reason that financiers, installers, or aggregators offer to buy SRECs at a certain price, and it’s because they believe they’ll earn more off of it long-term.

Cost of SRECTrade’s services

Like most companies, SRECTrade doesn’t offer its service for free. As a customer of SRECTrade, homeowners are required to pay a percentage of their earnings from SRECs for being the broker on their behalf.

The percentage of your SREC income that SRECTrade gets can depend on the size of your solar panel system, but for systems under 50 kW, SRECTrade is given a 7% fee with a minimum of $2.50 (not to exceed half the value of the SREC). In a lower-value SREC market like Maryland, this would translate to $2.50 for the sale of an SREC at $10, while in a market like Massachusetts today that fee is around $23 while SRECs are selling for around $325.

Next steps for solar in states with SRECs

In SREC eligible states, EnergySage approved installers should be familiar with the market, and your various options for SREC aggregators (including but not limited to SRECTrade). It’s definitely worth researching your options, and comparing both fees and risks associated with various brokers and options.

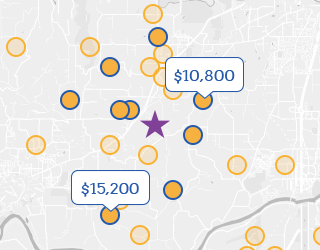

If you’re interested in exploring solar in your area and learning more about how much you can generate in SREC income by going solar, simply join EnergySage today. Quotes that installers upload onto our platform will automatically calculate an estimate for SREC earnings over 20 years in the “Production Incentives” section of the quote. These estimates will also be accounted for in payback period calculations and savings projections.