Homeowners, solar companies, and industry advocates alike were given a big Christmas gift in 2015 when Congress approved the 2016 federal spending bill and extended the solar panel tax credit. The December 18 bill contained a 5-year solar tax credit extension, which makes solar energy more affordable for all Americans. Wondering how this impacts you? EnergySage has the answers.

NOTE: We have a new piece with the most updated information about the ITC extension – check it out here.

Key takeaways

- You can save 26% on your solar installation with the federal investment tax credit (ITC)

- Originally, the ITC stepped down at the end of 2020–new legislation since has pushed that to 2022

- Start comparing solar quotes on the EnergySage Marketplace for maximum savings

What is the solar tax credit?

The federal solar tax credit, also known as the investment tax credit (ITC), allows you to deduct 26 percent of the cost of installing a solar energy system from your federal taxes. The ITC applies to both residential and commercial systems, and there is no cap on its value. Thanks to the ITC, the average EnergySage Solar Marketplace shopper saves thousands of dollars on the cost of going solar in 2020.

What does the federal solar tax credit extension mean for the solar industry?

The federal ITC was originally established by the Energy Policy Act of 2005 and was set to expire at the end of 2007. A series of extensions pushed the expiration date back to the end of 2016, but experts believed that an additional five-year extension would bring the solar industry to its full maturity. Thanks to the spending bill that Congress passed in late December 2015, the tax credit is now available to homeowners in some form through 2021. Here are the specifics:

- 2016 – 2019: The tax credit remains at 30 percent of the cost of the system. This means you can still get a major discount off the price for your solar panel system.

- 2020-2022: Owners of new residential and commercial solar can deduct 26 percent of the cost of the system from their taxes.

- 2023: Owners of new residential and commercial solar can deduct 22 percent of the cost of the system from their taxes.

- 2024 onwards: Owners of new commercial solar energy systems can deduct 10 percent of the cost of the system from their taxes. There is no federal credit for residential solar energy systems.

Do I qualify for the solar panel tax credit?

As long as you own your solar energy system, you are eligible for the solar tax credit. Even if you don’t have enough tax liability to claim the entire credit in one year, you can “roll over” the remaining credits into future years for as long as the tax credit is in effect. However, remember that if you sign a lease or PPA with a solar installer, you are not the owner of the system, and thus you cannot receive the tax credit.

How do I claim the solar tax credit?

You claim the solar tax credit when you file your yearly federal tax return. Remember to let your accountant know you’ve gone solar in the past year, or if you file your own taxes, use EnergySage’s step-by-step guide on how to claim the solar ITC.

More resources on the extension of the federal ITC

- The Wall Street Journal explores the legislation and what it means for today’s homeowners.

- Greentech Media conducted an in-depth analysis of the solar tax credit extension’s impact on the broader solar industry.

- Read the language of the official bill (Section 303, beginning on pg. 2005, details the specifics of the extension).

Three Tips for Solar Shoppers

1. Homeowners who get multiple quotes save 10% or more

As with any big ticket purchase, shopping for a solar panel installation takes a lot of research and consideration, including a thorough review of the companies in your area. A recent report by the U.S. Department of Energy’s National Renewable Energy Laboratory (NREL) recommended that consumers compare as many solar options as possible to avoid paying inflated prices offered by the large installers in the solar industry.

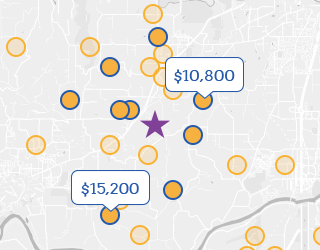

To find the smaller contractors that typically offer lower prices, you’ll need to use an installer network like EnergySage. You can receive free quotes from vetted installers local to you when you register your property on our Solar Marketplace – homeowners who get 3 or more quotes can expect to save $5,000 to $10,000 on their solar panel installation.

2. The biggest installers typically don’t offer the best price

The bigger isn’t always better mantra is one of the main reasons we strongly encourage homeowners to consider all of their solar options, not just the brands large enough to pay for the most advertising. A recent report by the U.S. government found that large installers are $2,000 to $5,000 more expensive than small solar companies. If you have offers from some of the big installers in solar, make sure you compare those bids with quotes from local installers to ensure you don’t overpay for solar.

3. Comparing all your equipment options is just as important

National-scale installers don’t just offer higher prices – they also tend to have fewer solar equipment options, which can have a significant impact on your system’s electricity production. By collecting a diverse array of solar bids, you can compare costs and savings based on the different equipment packages available to you.

There are multiple variables to consider when seeking out the best solar panels on the market. While certain panels will have higher efficiency ratings than others, investing in top-of-the-line solar equipment doesn’t always result in higher savings. The only way to find the “sweet spot” for your property is to evaluate quotes with varying equipment and financing offers.

For any homeowner in the early stage of shopping for solar that would just like a ballpark estimate for an installation, try our Solar Calculator that offers up front cost and long-term savings estimates based on your location and roof type. For those looking to get quotes from local contractors today, check out our quote comparison platform.