As you’re comparing your solar options, one of the biggest decisions you’ll need to make is how you’ll pay for your system. Fortunately, there are many accessible financing options available for those looking to install solar with little–or no–money upfront.

Given the number of solar financing options and the differences between them, we often get questions about the pros and cons of certain loans – truthfully, every financing solution has both. In this article, we’ll give you a quick overview of factors to consider with one common solar financing option: home equity loans.

An overview of home equity loans

A home equity loan, commonly referred to as a “second mortgage,” allows you to borrow against the equity you’ve accrued for your home. The amount you can borrow with a home equity loan depends on a number of factors, including the equity you’ve built up, income, and your credit score. When you finance your solar panel system with a home equity loan, you will typically repay the lender through monthly payments at a fixed interest rate.

As you’re comparing solar financing options, you may hear solar companies referring to home equity loans as a “secured” loan option – this means that the lender requires some sort of asset as collateral for the money you borrow. In the case of home equity loans, this typically means a lien on your property; if you default on payments, the lender has the right to take possession of your home.

You can read more about the differences between secured and unsecured solar loans in this article.

Advantages of financing solar with a home equity loan

For many, home equity loans are one of the most favorable solar financing solutions. Here are just a few reasons why:

Lower interest rates

Interest rates vary across all solar financing options, and depend on the type of loan, loan term, the lender, and personal financial circumstances. However, generally speaking, home equity loans typically have lower interest rates than many other solar loans. This is because they are secured with collateral (i.e. your home), so the lender assumes less risk when loaning you money.

Finding the most competitive interest rate can help you save a lot of money over time: the lower your interest rate is, the less you’ll owe your lender for borrowing money from them.

Tax benefits

Historically, interest payments on all home equity loans were tax-deductible. However, this changed with the Tax Cuts and Jobs Act of 2017: you can no longer claim deductions on your interest payments if you use your home equity loan for personal expenses, such as vacations, student loan payments, credit card debt, and more.

But if you want to use a home equity loan for solar, there’s some good news: according to the IRS, “the Tax Cuts and Jobs Act of 2017, enacted Dec. 22, suspends from 2018 until 2026 the deduction for interest paid on home equity loans and lines of credit, unless they are used to buy, build or substantially improve the taxpayer’s home that secures the loan.” Fortunately, solar installations can fall under that umbrella – and what better way to substantially improve your home?

Importantly, if you use a home equity loan for more than one purchase (i.e. a solar panel installation and a new car), you can only claim tax deductions on the interest payments for your home improvement project, not the entirety of the loan.

Always consult a tax professional!

U.S. tax code is complicated, and we’re not tax experts: what we have written should not take the place of advice from a qualified tax professional. Consult your tax advisor before deciding what is best for you.

Existing lender relationships

Do you have a good relationship with a local lender? Many homeowners first go to their existing local credit union or bank to obtain a home equity loan due to the convenience and familiarity. If you know your bank well and feel comfortable with their service and reputation, you may want to borrow money from them rather than starting afresh.

Disadvantages of financing solar with a home equity loan

Like all financing solutions, there are some downsides to taking out a home equity loan for your solar panel installation:

Longer approval process

Securing a home equity loan often involves a number of steps, including a property evaluation to assess the value of your home. Because of this, the closing process for a home equity loan can take several weeks. In comparison, you can receive approval for many unsecured solar loans in a matter of minutes.

Property lien

As mentioned above, lenders of home equity loans typically put a lien on your home, allowing them to repossess your property if you default. So, this is a downside to consider if you end up not being able to make your payments as planned.

Equity & debt-to-income requirements

Compared to other solar financing options, the approval requirements for home equity loans are a bit stricter.

For one, you need to have built up a certain amount of equity in your home – this is why home appraisals are typically part of the approval process. Most lenders require at least 15 to 20 percent equity in your property (i.e. your home value minus remaining mortgage payments) for home equity loan approvals.

In addition to equity, lenders will also assess your debt-to-income (DTI) ratio – this is essentially how much of your monthly income goes straight to paying off existing debt. If your DTI is less than 43 percent, you’re likely good for approval. Some lenders may grant approvals for DTIs as high as 50 percent.

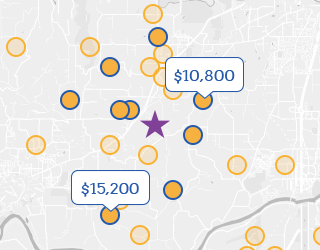

Compare solar financing solutions on EnergySage

When you’re comparing financing options, it’s a good idea to shop around – the same holds true for solar offers. On the EnergySage Marketplace, you can receive free custom solar quotes to compare online from local installers. If you’d like to include loan options in your solar quotes, simply note your preference for financing when registering. Or, if you’d like to start out with a quick estimate of your potential solar costs and savings, try our Solar Calculator.