If you’re considering solar, you’ve probably heard about the federal solar tax credit, also known as the federal Investment Tax Credit (ITC). If you have a solar system on your property, you’ve probably heard about the federal solar tax credit, also known as the federal Investment Tax Credit (ITC). The ITC makes solar more affordable for homeowners and businesses by granting a dollar-for-dollar tax deduction equal to 26% of the total cost of a solar energy system. There’s plenty of information out there about the value of the ITC, but figuring out how to actually claim the credit when it comes time to file your taxes is another story. In this article, we’ll walk you through the instructions step by step from figuring out if you’re eligible to completing Form 5695 to adding it to Schedule 3 and Form 1040.

Key takeaways

- Claiming the federal ITC involves determining your tax appetite and filling out the proper forms.

- The federal ITC remains at 26% for 2022.

- To claim the solar tax credit, you’ll need to first determine if you’re eligible, then complete IRS form 5695 and finally add your renewable energy tax credit information to Schedule 3 and Form 1040.

- Compare solar quotes on the EnergySage Marketplace to maximize your savings.

What’s in this article?

- The 3 steps to claiming the solar tax credit

- Are you eligible for the solar tax credit?

- What forms do you need?

- Instructions for filling out Form 5695

- Instructions for adding values to Schedule 3 and Form 1040

- How much does the solar tax credit save you?

The 3 steps to claiming the solar tax credit

There are three main steps you’ll need to take in order to benefit from the ITC:

- Determine if you’re eligible

- Complete IRS Form 5695

- Add to Schedule 3 and Form 1040

For the purposes of this article, let’s assume the gross cost of your solar system is $25,000.

Disclaimer: This article is intended to provide an informational overview of the Federal Solar Tax Credit for interested homeowners. It is not intended to serve as official financial guidance. Readers interested in installing solar products should use their best judgment and seek advice from a licensed professional before making any purchase or investment.

First things first: are you eligible for the solar tax credit?

You are eligible for the Federal ITC as long as you own your solar energy system, rather than lease it. If you sign a lease agreement, the third-party owner gets the solar tax credit associated with the system. This is also true for the vast majority of state and local incentives for solar, although in some special cases a lease will grant you the financial benefits associated with the sale of solar renewable energy certificates (SRECs). You are also eligible even if the solar energy system is not on your primary residence – as long as you own the property and live in it for part of the year, you can claim the solar tax credit.

If your federal tax liability is lower than the total amount of your ITC savings, you can still take advantage of it by carrying over any remaining credits to the following year. In our example, you pay $25,000 to install a solar system on your home in 2021, which means you are eligible for a $6,500 federal solar tax credit. If your federal tax liability for 2022 is only $5,000, you will owe no federal taxes that year, and in 2022, you will reduce your tax liability by $1,500.

| Solar system cost: $25,000 | ITC amount: $6,500 | Tax liability year 1 | Tax liability year 2 | Tax liability year 3 | Effective total solar system cost |

|---|---|---|---|---|---|

| ITC used completely in year 1 | Before ITC | $7,000 | $7,000 | $7,000 | $25,000 |

| After ITC | $500 | $7,000 | $7,000 | $18,500 | |

| ITC used completely over 2 years | Before ITC | $5,000 | $5,000 | $5,000 | $25,000 |

| After ITC | $0 | $3,500 | $5,000 | $28,500 | |

| ITC never applies due to low tax liability | Before ITC | $0 | $0 | $0 | $25,000 |

| After ITC | $0 | $0 | $0 | $25,000 |

What forms do you need to claim the ITC?

If you’ve determined that you’re eligible for the ITC, there are a number of tax forms and instructions you’ll need in order to claim you tax credit, including:

Instructions for filling out IRS Form 5695 for 2022

Claiming the ITC is easy. To get started, you’ll first need your standard IRS 1040 Form, IRS Form 5695, “Residential Energy Credits,” and the instructions for Form 5695. The purpose of Form 5695 is tovalidate your qualification for renewable energy credits.

1. Enter your energy efficiency property costs

Form 5695 calculates tax credits for a variety of qualified residential energy improvements, including geothermal heat pumps, solar panels, solar water heating, small wind turbines, and fuel cells. We’ll use $25,000 gross cost of a solar energy system as an example.

First, you will need to know the qualified solar electric property costs. This is the total gross cost of your solar energy system after any cash rebates. Add that to line 1. Next, you’ll insert the total cost of any additional energy improvements, if any, on lines 2 through 5, and add them up on line 6a. In this example, we’ll assume you don’t have any additional energy efficiency property costs.

On line 6b, multiply line 6a by 26%. This is the total value of your tax credit (but not necessarily the amount you’ll receive, depending on your tax liability).

Assuming you are not also receiving a tax credit for fuel cells installed on your property, and you aren’t carrying forward any credits from last year, put the value from line 6b on line 13 of form 5695.

2. Determine your tax liability

Now you need to calculate if you will have enough tax liability to get the full 26% credit in one year. To get started, you first need to have completed sections 1 through 18 on your standard 1040 Form. For the purposes of this example, we’ll assume your tax liability is equal to $5,000.

Now, you’ll need the instructions for Form 5695. On page 4, you’ll see a worksheet to calculate the limit on tax credits you can claim. Add the number on line 18 of your 1040 Form to line 1 of this worksheet. If you’re claiming tax credits for things like adoption expenses, interest on a mortgage, or buying a plug-in hybrid or electric vehicle, you’ll need that information in line 2. You’ll then subtract the number on line 2 from line 1 to determine your residential energy efficient property credit limit. (For this example, it’s still equal to $5,000).

3. Calculate your tax credit

Finally, you’ll need to enter the result of line 3 of the worksheet on line 14 of Form 5695. Review line 13 and line 14, and put the smaller of the two values on line 15.

If your tax liability is smaller than your tax credits, subtract line 15 from line 13, and enter it on line 16. That’s the amount you can claim on next year’s taxes.

Instructions for adding values to Schedule 3 and Form 1040 for 2022

The value on line 15 is your amount of renewable energy credit this year. You’ll need to add that number to Schedule 3 and ultimately to your regular tax form, IRS Form 1040.

1. Enter into Schedule 3

First you need that number on line 15 from Form 5695, which, in our example, is $5,000. Add this number to line 5 on Schedule 3 (and make sure to attach Form 5695!).

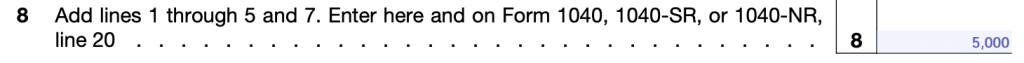

After adding in any other nonrefundable tax credits (which our example is $0), you’ll add up your total sum of refundable tax credits on line 8.

2. Add to Form 1040

Finally, you’ll need to take the number from Schedule 3, line 8 and add it to Form 1040, line 20 – and voila! You’ve claimed the solar tax credit!

How much does the solar tax credit save you?

What does 26% actually mean for the average solar shopper? According to EnergySage marketplace data, the average national gross cost of installing a solar panel system in 2022 is $27,700. At that price, the solar tax credit can reduce your federal tax burden by $7,202, bringing your total cost down to just $20,498 – and the ITC is just one of many rebates and incentives that can reduce the cost of solar for homeowners!

Don’t own a solar system yet? Compare quotes on EnergySage

If you haven’t started your solar journey yet, the first thing you need to know is that the best way to maximize your return on investment is to compare quotes. On the EnergySage Marketplace, you’ll receive free, custom quotes from our network of pre-vetted installers. And remember: because the ITC is currently set at 26%, as long as you have enough tax liability, you’ll receive a tax deduction equal to 26% of the total cost of your solar system.

The federal solar tax credit allows you to deduct 26 percent of the cost of installing a solar energy system from your federal taxes.

There is no income limit on the ITC program, so taxpayers in all income brackets may be eligible.

If you’re eligible for the ITC, but you don’t owe any taxes during the given calendar year, the IRS will not refund you with a check for claiming the credit. However, according to Section 48 of the Internal Revenue Code, the ITC can be carried back one year and forward 20 years. Therefore, if you had a tax liability last year, but don’t have any this year, you can still claim the credit.

There are three main steps you’ll need to take in order to benefit from the ITC:

1. Determine if you’re eligible

2. Complete IRS Form 5695

3. Add to Schedule 3 and Form 1040