The country’s best solar incentive, the federal investment tax credit (ITC), is in the process of winding down. 2019 was the last year you could claim the full 30 percent tax credit. Starting in 2020, the credit dropped to 26 percent, and will drop to 22 percent in 2023 and disappear entirely for homeowners in 2024. This impending deadline has prospective solar shoppers rushing to take advantage of the maximum credit while they still can – but how can you make sure you’re eligible for the current 26 percent credit?

Thanks to the “commence construction” guidance outlined by the IRS, there’s a bit more flexibility when it comes to claiming the solar tax credit than there has been in past years. However, this guidance doesn’t apply to everyone going solar: in this article, we’ll dive into the basics of the commence construction guidance, and what it means for property owners looking to take advantage of the 26 percent federal tax credit.

Please note: EnergySage has written on the topic of the ITC in good faith with the aim of guiding you to make a well-informed decision about going solar. However, the US tax code is complicated, and what we have written should not take the place of advice from a qualified tax professional. Consult your tax advisor before deciding what is best for you.

What does “commence construction” mean?

When it comes to the solar tax credit, “commence construction” refers to when you begin construction on your solar panel system. Historically, taxpayers could only claim the federal solar tax credit in the year their solar panel system was placed in service, after obtaining permission to operate (PTO). When Congress decided to extend the credit in 2015, they determined that certain solar panel system owners henceforth would be eligible to claim the credit in the year that construction began on the project, with some caveats.

Which properties are eligible for “commence construction” benefits?

The IRS’ commence construction guidance applies to all solar projects looking to take advantage of the business solar tax credit; however, the “commence construction” provisions and the related IRS guidance do not apply to the residential solar tax credit.

The ITC relates to two separate tax credits: the section 48 credit and the section 25D credit. The section 48 credit is intended for solar panel systems owned by a corporate entity, such as utility-scale installations, commercial projects, or third-party-owned residential systems (where lessors like SunRun or Vivint claim the tax credit). On the other hand, the section 25d credit is for directly-owned, residential solar panel systems, allowing taxpayers to claim the credit on their personal tax returns.

Importantly, “commence construction” provisions are only applicable to taxpayers taking advantage of the section 48 credit, and the guidance described below only applies to this credit.

If you plan on installing a residential solar panel system and want to claim the 26 percent credit yourself, having the system fully installed and operational before the end of 2022 is your safest bet for ensuring that you can claim the maximum benefit. That said, as with any tax-related incentives, we recommend consulting with a tax advisor or accountant on this matter, as they are the best suited to give formal tax advice.

The new “commence construction” guidance

As “commence construction” pertains to the solar tax credit, it wasn’t always clear as to what constituted as the beginning of construction. The lack of clarity left many in the solar industry – particularly developers and commercial property owners – concerned about the step-down and worrying about how uncertainty over the definition of the “commence construction” clause would impact the economics of the potential system. But in June 2018, the IRS published clearer guidance regarding the tax credit (and favorable guidance, at that).

In this guidance, the IRS states that solar projects are eligible for the tax credit value for the year they “commence construction,” and there are two different tests to determine whether construction has started for a solar project: the Physical Work Test or the Five Percent Safe Harbor Test.

Physical Work Test

The Physical Work Test states that if physical construction starts on your solar project prior to the end of 2022, you’re eligible for the 26 percent tax credit. However, not every type of work passes this test; according to the IRS, the work needs to be “physical of a significant nature.” Many on-site tasks for installing solar panel systems (i.e. affixing mounting equipment, installing panels or inverters) meet this requirement. Off-site tasks (i.e. permitting, interconnection paperwork, system design) or preparing a property for installation (i.e. tree removal, re-roofing) do not qualify.

Five Percent Safe Harbor Test

If a solar project that begins in 2022 doesn’t pass the Physical Work Test, it may still be eligible for the 26 percent credit depending on how much money has already been invested in the project: those who start construction in 2022 and spend 5 percent or more of total PV system costs before the end of the year can claim the 26 percent credit.

Other rules about “commence construction” guidance

Importantly, you can’t simply start your project in 2022 in order to meet the Physical Work Test or Five Percent Safe Harbor Test only to stop construction: you need to continuously make progress on the project and be able to provide proof of the progress, such as regular payments on your system. Additionally, your solar panel system needs to be up and running by January 1, 2026 at the latest in order to claim the full credit.

Claim federal solar incentives before it’s too late

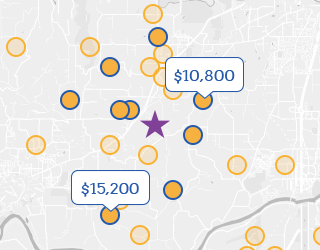

If you want to take advantage of the federal solar tax credit, there’s no better time to start shopping for solar than now. On the EnergySage Solar Marketplace, you can receive up to seven custom solar quotes to compare online in an apples-to-apples format. All of these quotes will include incentives you’re eligible for, including but not limited to the ITC. If you’d prefer to start your solar project with some ballpark estimates, try our Solar Calculator.