The investment tax credit (ITC), also known as the federal solar tax credit, allows you to deduct 26 percent of the cost of installing a solar energy system from your federal taxes. The ITC applies to both residential and commercial systems, and there is no cap on its value. The average EnergySage Marketplace shopper saves nearly $9,000 on the cost of going solar as a result of the ITC. Curious as to how much you can save on solar? Read our article for more information based on your unique energy needs.

Disclaimer: This article is intended to provide an informational overview of the Federal Solar Tax Credit for interested homeowners. It is not intended to serve as official financial guidance. Readers interested in installing solar products should use their best judgment and seek advice from a licensed professional before making any purchase or investment.

Key takeaways

- In 2022, the ITC allows both homeowners and businesses to claim 26 percent of your solar system costs from your taxes.

- The credit rolls over, so you don’t have to have enough tax liability to use it all in one year.

- You must own your solar system to take advantage of the ITC – if you signed a solar lease or PPA, you won’t receive this benefit.

- Use the EnergySage Marketplace to compare solar system quotes.

What you’ll learn in this article

- What is the federal solar investment tax credit?

- How does the tax credit work?

- Are you eligible for the tax credit?

- What’s covered by the tax credit?

- When can you claim the tax credit?

- Using the tax credit with other incentives

- How do you claim the tax credit?

- Frequently asked questions

What is the federal solar investment tax credit?

The ITC was originally established by the Energy Policy Act of 2005 and was set to expire at the end of 2007. Thanks to the popularity of the ITC, and its success in supporting the United States’ transition to a renewable energy economy, Congress has extended its expiration date multiple times, including most recently in December 2020 to extend the ITC at 26 percent for two additional years. Now, the solar investment tax credit is available to homeowners in some form through 2022. Here are the specifics:

- 2016 – 2019: The tax credit remains at 30 percent of the cost of the system.

- 2020-2022: Owners of new residential and commercial solar can deduct 26 percent of the cost of the system from their taxes.

- 2023: Owners of new residential and commercial solar can deduct 22 percent of the cost of the system from their taxes.

- 2024: Owners of new commercial solar energy systems can deduct 10 percent of the cost of the system from their taxes. There is no federal credit for residential solar energy systems.

How the solar tax credit works

As long as you own your solar energy system, you are eligible for the solar investment tax credit. Even if you don’t have enough tax liability to claim the entire credit in one year, you can “roll over” the remaining credits into future years for as long as the tax credit is in effect. However, remember that if you sign a lease or power purchase agreement (PPA) with a solar installer, you are not the owner of the system, and therefore cannot claim the tax credit. Lastly, it’s important to note that there is no income limit on the ITC program, so taxpayers in all income brackets may be eligible.

Solar tax credit eligibility checklist for 2022

If you’re not sure the ITC applies to you and your home, here is a checklist of criteria to keep in mind:

- Your solar photovoltaic (PV) system was installed between January 1, 2006 and December 31, 2023.

- Your solar PV system was installed on your primary or secondary residence in the United States.

- For an off-site community solar project, the electricity generated is credited against, and does not exceed, your home’s electricity consumption. The IRS allows a taxpayer to claim a section 25D tax credit for purchasing a portion of a community solar project.

- You own the solar PV system, meaning you purchased it outright or financed it with a loan. You did not sign a lease or PPA.

- Your solar PV system is new or being used for the first time—the credit can only be claimed on the original installation of the solar equipment. For instance, if you bought a house that came with a solar system already installed, you would not be eligible for the credit.

What’s covered by the tax credit?

Homeowners who leverage the 26 percent ITC can plan to see the following covered:

- Cost of solar panels

- Labor costs for installation, including permitting fees, inspection costs, and developer fees

- Any and all additional solar equipment, like inverters, wiring, and mounting hardware

- Home batteries charged by your solar equipment

- Sales taxes on eligible expenses

When and for how long can I claim the solar tax credit?

If you’re eligible for the ITC, but you don’t owe any taxes during the given calendar year, the IRS will not refund you with a check for claiming the credit. The 26 percent ITC is not refundable. However, according to Section 48 of the Internal Revenue Code, the ITC can be carried forward up to five years. Therefore, if you have a tax liability next year, but don’t have any this year, you can still claim the credit.

Using the federal tax credit in combination with other incentives

Aside from the ITC, there are several other solar incentives to consider like rebates, state-sponsored programs, and other tax credits depending on where you live. While some of these financial incentives may impact the ITC, others can be combined to lower the cost of going solar. Here’s what you need to know about combining solar incentives with the federal ITC:

- Rebates from your utility company: As a general rule of thumb, subsidies from your utility company will be excluded from income tax returns. So, in this case, any utility rebate for installing solar would be subtracted from your system cost before you can calculate the tax credit.

- Rebates from the state: These types of rebates typically do not reduce your federal tax credit.

- State tax credit: If you get any state tax credit for your solar system, it will not decrease your federal tax credits. However, keep in mind that getting a state tax credit means that your taxable income on federal returns will be higher since you will have less state income tax to deduct.

- Payments from renewable energy certificates: Any time you receive money from selling renewable energy certificates, it will likely be considered taxable income that will increase your gross income. But, it will not reduce your tax credit.

How do I claim the federal solar tax credit?

You claim the investment tax credit for solar when you file your yearly federal tax return. If you have an accountant, remember to let them know you’ve gone solar in the past year, or if you file your own taxes, simply use EnergySage’s step-by-step guide on how to claim the solar ITC.

Impact of the solar tax credit

As the United States races to achieve rigorous clean energy benchmarks, the federal policies and incentives to get us there have heightened. On both a distributed and utility-scale level, solar deployment has grown quickly across the country. The federal tax credit has given businesses, homeowners, and tax payers the opportunity to drive down solar costs while increasing long-term energy stability. The ITC has been a driver of huge success, giving us a stronger and cleaner future: in fact, according to the Solar Energy Industries Association (SEIA), it has helped the U.S. solar industry expand by over 10,000 percent! Learn more about how solar panel costs and efficiency have changed over time.

Frequently asked questions about the solar tax credit

Calculating the cost of going solar can be complicated as it is, let alone incorporating other financial incentives and tax credits into your estimate. Check out a few other commonly asked questions related to the ITC for more clarification:

In 2022, the federal solar tax credit will deduct 26 percent of the cost of a system for eligible residential and commercial tax payers. After this year, new residential and commercial solar customers can deduct 22 percent of the cost of the system from their taxes.

Right now, the ITC is a one-time credit. But, you may carry over the excess credit to the next year if you can’t use it all when you file. For example, if you only owed $6,000 in taxes but received the $6,200 solar tax credit, you’d pay $0 in taxes for the year when you placed the claim. Then, you’d also get to reduce next year’s taxes by the remaining $200.

The solar tax credit will not increase your tax refund. Rather, The ITC amount is applied against your tax liability, or the money you owe the IRS.

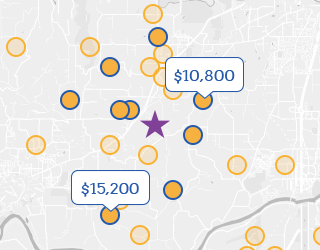

Start your solar journey today with EnergySage

EnergySage is the nation’s online solar marketplace: when you sign up for a free account, we connect you with solar companies in your area, who compete for your business with custom solar quotes tailored to fit your needs. Over 10 million people come to EnergySage each year to learn about, shop for, and invest in solar. Sign up today to see how much solar can save you.