Solar loans are the fastest growing method of financing a solar panel installation. Across the country, the majority of new solar installations are purchased with either a cash purchase or through a solar loan. Sungage Financial, based in Boston, Massachusetts, is a popular financier in the residential solar industry. If you’re comparing solar quotes from a few different solar installers, you may have received a loan option from Sungage. Here’s what you need to know about Sungage and their products.

How Sungage solar financing works

Solar shoppers typically have a few different ways to pay for their solar panel installation. People who are less concerned about maximizing their financial savings can sign a solar lease or power purchase agreement (PPA) with a solar company; however, homeowners who want to access the greater financial benefits that come from owning a system outright typically choose to buy it, either in cash or with a solar loan. These solar loans can come from a bank or through a specialized solar lender.

Sungage is a specialized solar lending company that offers loans through their network of installer partners. Importantly, Sungage Financial is not a bank; rather, they offer loans through a bank partnership model with NBT Bank. Sungage provides the customized platform to make the loan process easier for homeowners and installer partners, while NBT Bank, a federally chartered national bank, brings a low-cost, consistent source of funding to the partnership. In practical terms, this means that when you finance your project with Sungage, you use the Sungage platform for the application, approval, and completion of the loan agreement, then monthly payments for the loan are sent directly to NBT.

Sungage’s solar loans are exclusively offered to homeowners through their contractor network. When your installer creates a quote for a solar energy system installation, they often include a built-in financing option from a company like Sungage.

Sungage’s solar lending options

Every home solar installation is different, and Sungage’s product offerings are flexible to various customer needs and preferences. Loan amounts, terms, and interest rates will depend on the specifics of each installation.

Loan amounts

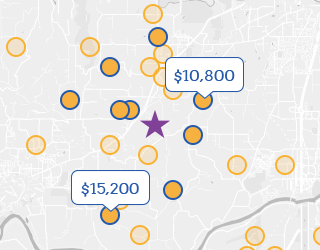

Sungage offers loans between $7,500 and $100,000; their maximum loan amount is more than enough to cover the cost of installing a residential solar panel system in the U.S.

Loan terms

Sungage has a variety of loan terms designed to fit meet various needs, whether you’re interested in the lowest monthly payment possible or the quickest payoff. Their loan offerings come in 5, 10, 15, and 20-year terms. Interest rates for the loan vary depending on the term and other factors. Importantly, if you borrow through Sungage, you can pay off your loan at any point without incurring prepayment penalties.

Additional advantages of financing through Sungage

In addition to no prepayment penalties and flexible loan options, here are some of the other advantages of financing with Sungage.

Zero-interest bridge loan

When you purchase a solar panel system, you’re eligible to claim the federal solar tax credit. However, since this incentive is a tax credit, you won’t receive this credit right away; rather, you’ll receive the incentive as a tax credit on your next year’s taxes. If you decide to pay for your solar energy system with a loan, this could mean that you have to pay interest on the tax credit portion of your solar costs.

The zero-interest bridge loan, which is a unique offering from Sungage, allows you to receive your tax credit in full and pay this portion of the loan back without any interest payments, while also beginning to pay down the principal balance on your investment on day one. In some markets like New York, Illinois, and South Carolina, Sungage allows local incentives and state tax credits to also be included in the zero-interest portion of the loan.

Transferrable loans

If you want to sell your solar home prior to paying off your loan from Sungage, they provide a transferability option that allows the new homeowner to take over monthly payments for solar after the sale of your house.

Service

Sungage provides borrowers with an efficient application and approval process. Additionally, the company has a devoted team for customer support available by phone. Homeowners can easily connect with real humans who are knowledgeable about solar and finance products.

Roofing, batteries and site preparation

If you need to re-roof before installing solar or if you’d like to pair your solar installation with a battery, you can wrap in these costs into your solar loan. In addition, the Sungage solar loan can include some site preparation costs. This allows you to streamline payments into one monthly bill, rather than paying several different financiers each month.

No home equity required

Loans from Sungage are secured, meaning they require collateral. However, the collateral that backs the loan is the solar equipment itself, rather than a lien secured by your property. As such, you don’t need home equity in order to get approved for a loan from Sungage.

Sungage loans vs. other loans

As mentioned above, homeowners have a few different options for financing solar projects. The best loan for you depends on your priorities.

Solar is a relatively new technology, and some banks may be hesitant to provide financing for it. While this is less of an issue today than it was a few years ago, the fact remains that a company like Sungage that specializes in solar loans is sure to be prepared with answers to any solar-lending related questions you might have.

Another area where Sungage shines is in its fast approval process. If you want to finance your solar installation with a home equity loan or line of credit, it can take several weeks for the loan to close, and you need to have significant equity in your home to qualify. By comparison, a Sungage application takes a few minutes online and credit decisions are typically made in a few seconds.

If you have a strong relationship with your local bank and they are willing to offer you solar financing through a home equity loan or line of credit, you may want to compare the benefits of that option against Sungage’s solar loan option.

Where to get a Sungage solar loan for your home or business

Sungage solar loans are offered through the company’s installer network, which means you work with your solar installer to finance with Sungage. Many of the local installers who provide solar quotes on the EnergySage Solar Marketplace use Sungage Financial as their loan provider. If you’re interested in a loan from them, simply join EnergySage today and indicate Sungage as your preferred lender when you register your property.