Installing solar at your home or business has significant financial benefits. In many cases, you can choose a zero down solar financing option and install your system without paying any money up front, leading to instant savings. In this article, we will examine the various options for $0 down solar and the merit of each option.

Zero-down solar: frequently asked questions

The idea of “zero-down” anything can be very appealing, especially for big-ticket purchases like cars and solar panels. Before you pick a zero-down option (detailed below), it’s important to ask the right questions:

Yes! Financing models like solar leases, power purchase agreements (PPAs), and even solar loans can have versions requiring no money initially, and instead will cost you in the form of regular payments, similar to when you lease a car.

While most zero-down solar plans won’t save you as much money throughout the lifetime of your solar panel system as buying it outright, you will still save significant money on your electricity bill. Of course, factors like local electricity rates, incentives, and your personal usage impact your total savings under any kind of financing plan.

If you prefer to spread your solar payment over a long period of time, a zero-down option might be right for you. However, if you are willing to spend a chunk of money upfront, you’ll likely save more money over the 25-30 year lifetime of your solar panel system by not going solar.

What are your zero-down solar options?

There are several zero-down solar options that enable you to move forward with a solar energy project without worrying about upfront costs. Solar leases, power purchase agreements (PPAs), and solar loans are all common financing options available with zero down options.

Solar leases

One way to finance a solar energy system is with a $0 down solar lease. With a solar lease, you enter into an agreement with a leasing company for the energy that your solar panels generate. In exchange, you pay a fixed monthly “rent,” which is based on the estimated electrical production of your system.

In a solar lease agreement, the company that you lease from owns and maintains the system. As a result, they are entitled to any rebates, tax breaks, or other incentives that come with installing solar panels.

Most solar leases require no money up front when you sign your agreement. Once your solar panels are installed and operational, you begin to pay the monthly “rent” for your system, which can be anywhere from 10% to 30% lower than your typical utility electricity rates. Most solar lease agreements require a rate increase of one to three percent each year, which is based on the expected increase in your utility electricity rates.

Power purchase agreements (PPAs)

$0-down solar PPAs, or power purchase agreements, work essentially the same way as solar leases. You agree on a set price for your electricity with your provider and receive the full power benefits from your solar energy system. Your PPA provider “owns” the system and receives its financial benefits (rebates, tax breaks, other incentives).

The main difference between PPAs and solar leases is how your payment is calculated. In a PPA, you agree to purchase the power generated by your system at a set per-kWh rate, rather than the fixed monthly “rent” you would pay in a solar lease.

Under a zero down solar PPA, you owe nothing upfront to your provider, and agree to pay for the electricity your system produces at a set rate. Like solar leases, your rate is likely between 20% and 30% lower than utility electrical rates, and it will usually increase by one to three percent per year (depending on your agreement).

Read more in our complete overview of power purchase agreements.

Solar loans

A third option for $0-down solar is a solar loan. When you finance with a solar loan, you borrow money from a lender to purchase your solar energy system, and pay it back in monthly installments with interest. If you choose a solar loan to finance your solar panels, you are the system owner (unlike in leases or PPAs), which entitles you to the financial benefits such as the solar investment tax credit (ITC).

Many solar loans come with a zero-down option. Even if you put no money down, you still pay back your loan with monthly installments. The amount you pay per month depends on how much your system cost to install, your interest rate, your loan term, and the type of loan you choose.

Check out our video below for an overview of the three main ways to finance a solar panel installation:

Find the right zero down solar financing plan for you

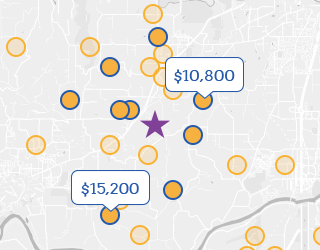

There are many $0 down solar financing options available to homeowners, but the economic benefits depend on the one that you choose. When shopping for solar, knowing your options and how they compare is vital to make sure you get the best solar system and financing plan for your unique property. On the EnergySage Solar Marketplace, you can solicit quotes from qualified, pre-vetted installers and compare them side by side to understand the financial benefits of each type of installation – and choose the right one for your needs.